Published on: September 9, 2025

Trump’s Reciprocal Tariffs: Impact on the Market and Key Currencies

| Table of Content |

| What Are Reciprocal Tariffs and Why Are They Back? |

| Definition and Strategic Purpose |

| Overview of Trump’s 2025 Tariff Agenda |

| Countries Targeted and Industries Affected |

| Immediate Market Reactions on the Reciprocal Tariffs |

| Volatility in Commodity Markets (Oil, Gold) |

| Currency Fallout – Who Gains and Who Loses? |

| Tariff-Driven Capital Flows and Forex Volatility |

| Long-Term Implications for Global Trade and Investors |

| Which Assets May Outperform in a Pro-Tariff Climate |

| Conclusion |

Let’s make sense of the U.S. President Donald Trump’s controversial tariff talk without the jargon. You’ll get the research you need, plus a little storytelling to keep things moving. Think of this as your guided tour: we’ll add context and color, so you can scan, learn, and act.

Before we dive in, remember that with amana you also get the biggest crypto selection in MENA — a reminder that diversification matters just as much as tariffs.

What’s more ,with amana, you can even fund your account with crypto.

What Are Reciprocal Tariffs and Why Are They Back?

Reciprocal tariffs have re-entered the chat because they’re a clean, headline-friendly lever: match the other side’s barriers, nudge the trade balance, and send a political message in one move. If you’re hearing echoes of 2018-style trade strategy, you’re not wrong—only this time the playbook is more overtly “mirror what we face.”

Definition and Strategic Purpose

Here’s the core, straight from our Research Team—read it as the “what, why, how, and for whom”:

- Short definition: a tariff regime that applies duties back to exporters from countries that apply high import barriers or subsidize exports — deployed as a bargaining tool.

- Policy rationale: presented as a means to shrink large goods deficits and protect key domestic industries (steel, semiconductors, EV components).

- Economic mechanism: tariffs raise import prices (increasing domestic input costs for some sectors), incentivize local sourcing, and aim to shift trade balances over time but can also pass costs to consumers.

- Political signal: used to show strength in trade negotiations and to galvanize specific voter blocs tied to manufacturing and energy regions.

Overview of Trump’s 2025 Tariff Agenda

The rollout came in waves of announcements, pauses, and revisions — each move closely tracked by markets.

- Timeline highlights: major reciprocal tariffs announced April 2, 2025; later modifications and temporary pauses followed through mid-2025 as bilateral talks proceeded

- Key policy mechanics: combination of country-specific rates and a baseline reciprocal levy; several executive orders were used to set and later adjust rates.

- Initial large country-specific rates were later scaled back in many cases to baseline levels (e.g., temporary reductions to ~10% as negotiations advanced).

- The administration used pause windows (90-day negotiation windows) to encourage bilateral deals rather than immediate indefinite escalation

Countries Targeted and Industries Affected

If your supply chain touches metals, autos, chips, or consumer tech, then this section is your weather report.

- Primary targets: China was the earliest and most prominent focus, with later measures affecting many trading partners and select product categories.

- Sector focus: heavy industry (steel, aluminum), EV and auto components, semiconductors, select consumer electronics — these were repeatedly named in administration materials and media summaries.

- Risk concentration: countries heavily integrated into global manufacturing (China, EU members with auto/air supply chains) and commodity exporters faced tailored rates or exceptions.

- Some treaty/WTO-sensitive products (e.g., civil aircraft components) or partners received narrow exemptions or temporary relief in specific negotiations.

Immediate Market Reactions on the Reciprocal Tariffs

Policy is the headline; price is the verdict. Here’s how risk assets behaved around the announcements and negotiation windows.

- Initial volatility: major US indices sold off on early announcements (April), with a material intra-month drawdown in risk assets tied to trade uncertainty; losses were concentrated in cyclical and export-exposed names.

- Tech concentration: the largest tech names (the “Magnificent Seven”) underperformed relative to the rest of the market in the immediate aftermath as risk premium widened and supply-chain concerns rose.

- Rebound dynamics: when the administration signaled pauses or negotiation windows, markets staged recoveries — illustrating that communications and timing mattered as much as the policy itself.

Volatility in Commodity Markets (Oil, Gold)

Commodities wore the mood swings—all while macro and geopolitics did their usual push-and-pull.

- Oil reaction: prices swung on tariff headlines and the related geopolitical signals — Brent traded in a band near the low-to-mid $60s–$70s per barrel in July–August 2025 as uncertainty and supply dynamics evolved. Recent settled prices cited around $66–72/b depending on news flow.

- Gold as a haven: investors increased allocations to safe havens at times of peak tariff fear; year-to-date gains in gold were reported in double digits in 2025 amid policy-driven risk sentiment shifts. (25% YTD return, surge from $2665 to actual levels at $3335).

- Energy importers: countries reliant on imported oil faced a potential lift in import bills if tariffs disrupted trade flows; conversely, some commodity exporters saw mixed outcomes depending on commodity and shipping effects.

Currency Fallout – Who Gains and Who Loses?

FX was the message board for global confidence: every escalation/softening showed up in the dollar and its pairs. Was USD strengthening or weakening? Was it a safe haven or sentiment casualty? Well, in 2025, the answer depended on the week.

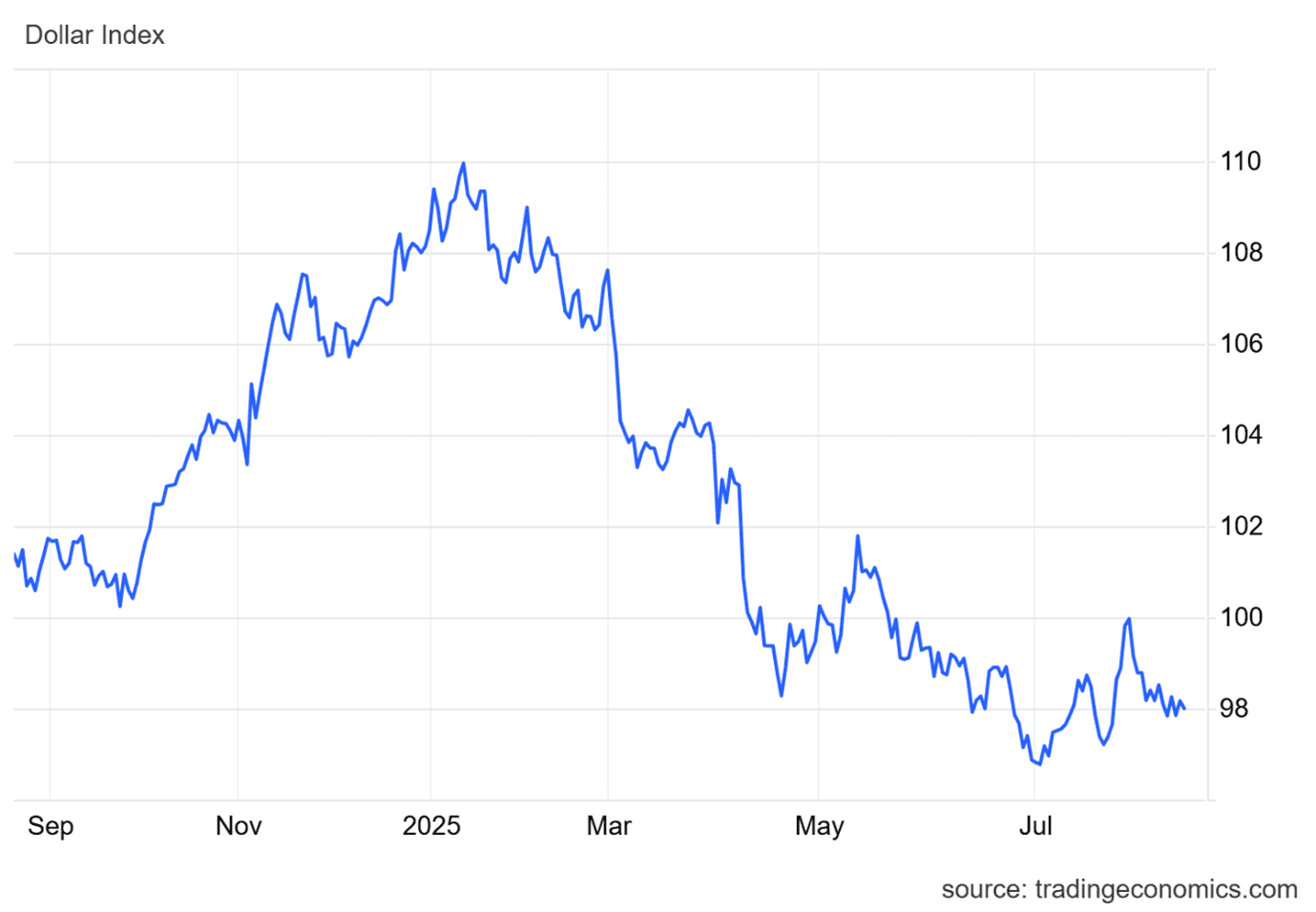

- Net direction in 2025: the dollar weakened notably during parts of 2025 (DXY down ~8–11% in H1 2025 vs. prior year-end), reflecting portfolio rebalancing and changing expectations about growth and policy.

- Transmission channels: tariffs can lower foreign confidence in US equities and incentivize dollar selling, while safe-haven reserve demand can pull the dollar in the other direction — markets in 2025 showed periods of depreciation rather than consistent appreciation.

- Short-term impact: episodes of tariff escalation produced sharp intraday FX moves and elevated implied volatility in major pairs (EUR/USD, USD/JPY), which is important for risk managers and FX hedges.

Tariff-Driven Capital Flows and Forex Volatility

When tariffs ramped up, global money shifted: investors pulled back from U.S. risk assets and moved funds into alternatives, safe havens, and select surplus-driven markets.

- Portfolio rebalancing: evidence shows foreign investors reduced US equity exposure around the announcement window, driving downward pressure on the dollar and large FX flows into alternatives and commodities.

- Currency winners/losers: commodity exporters and countries with trade surpluses tied to unaffected markets (e.g., certain emerging exporters) saw episodic currency support; export-dependent Asian FX pairs experienced sharp intra-period swings.

- Hedging implications: corporations with open FX exposure faced wider hedging costs as implied volatilities rose, increasing the cost of short-term protection for importers and exporters.

Long-Term Implications for Global Trade and Investors

Beyond short-term volatility, tariffs are shaping the longer-term landscape of trade, investment, and portfolio strategy in ways investors can’t ignore.

- Supply-chain reconfiguration: tariffs incentivize on-shoring and near-shoring for sensitive inputs; expect multiyear capex cycles in semiconductor fabs, battery supply, and local metal refining capacity. This will gradually change trade composition and cross-border value chains

- Inflationary pressure: persistent tariffs can lift import prices and feed into consumer inflation — central banks may react, influencing rates that affect equities and fixed income. Recent data through mid-2025 showed stickier wholesale inflation in some categories.

- FDI and industrial policy: presented deals and privatizations could attract or re-route foreign direct investment depending on market access and the clarity of trade rules; governments may counter with incentives to retain investment.

- Portfolio strategy: longer-term investors should reassess exposure to global supply chain leaders, favor companies with strong pricing power and flexible sourcing, and consider infrastructure and commodity allocations as partial hedges.

Which Assets May Outperform in a Pro-Tariff Climate

In the end, here is your practical cheat sheet—where flows may build, what to watch, and how to think about protection.

In a tariff-heavy environment, certain assets tend to attract capital as investors look for safety, inflation protection, or ways to hedge volatility.

- Defensive and cyclical plays: historically, gold and commodities have attracted flows during trade uncertainty; energy and basic materials companies can be beneficiaries if tariffs stoke inflation or protect local producers.

- Safe income and inflation protection: real assets and inflation-linked bonds tend to do better when import costs rise and fixed income real yields are pressured.

- Volatility instruments: options strategies or volatility-linked products may see heightened demand for hedging; VIX products spike around sharp policy moves.

- Watch zones to monitor: bond yields, central bank minutes, bilateral negotiation calendars — these will be leading indicators for market repricing.

Conclusion

If you made it this far, you’re already ahead of most of the timeline traders. Bookmark the sections that map to your portfolio (equities, FX, commodities), and keep an eye on the negotiation “pause windows”—they’ve been the swing factor for both drawdowns and rebounds.

Check Out Our RealVision Academy Trading Articles

Unlock expert trading strategies, market analyses, and step-by-step tutorials to sharpen your skills and grow your portfolio.

| Related articles |