Published on: August 23, 2025

Trump Coin vs Real Assets: Would You Trust a Memecoin Over Gold?

| Table of Content |

| Real Assets vs. Digital Assets |

| The Nature of Meme Coins |

| The Case for Gold |

| The Case for Trump Coin |

| Who Is Investing in What? |

| Building a Balanced Portfolio |

| Final Thoughts: Reality vs. Hype |

Since the dawn of crypto, we’ve seen the rise of countless digital assets—altcoins, stablecoins, and, of course, memecoins. While each has its own structure and purpose, memecoins have captured the most buzz lately, often blending internet culture, humor, and even politics. Case in point: U.S. President Donald Trump’s very own Trump Coin.

So, how does something like Trump Coin compare with a time-tested heavyweight like gold? Let’s break down the differences in value, trust, and risk—and see where you can trade both with ease.

Trump Coin vs Gold… which would you pick?

💡 Before you dive in: amana offers the biggest crypto selection in MENA – over 375+ cryptocurrencies to choose from.

And did you know? You can also fund your amana account with crypto!

Defining Real Assets vs. Digital Assets or Memecoins

What is a Real Asset?

A real asset is physical and tangible, with practical uses that range from jewelry and technology to central bank reserves.

It’s widely trusted as a store of value and has historically served as an inflation hedge over longer horizons—often rising significantly over 10- and 20-year periods. In 2025, gold in particular has surged nearly 26% in H1 2025—outshining equities as a weaker U.S. dollar, steady rates, and mounting geopolitical jitters drove investors to pile in. (Source: Emirates News Agency)

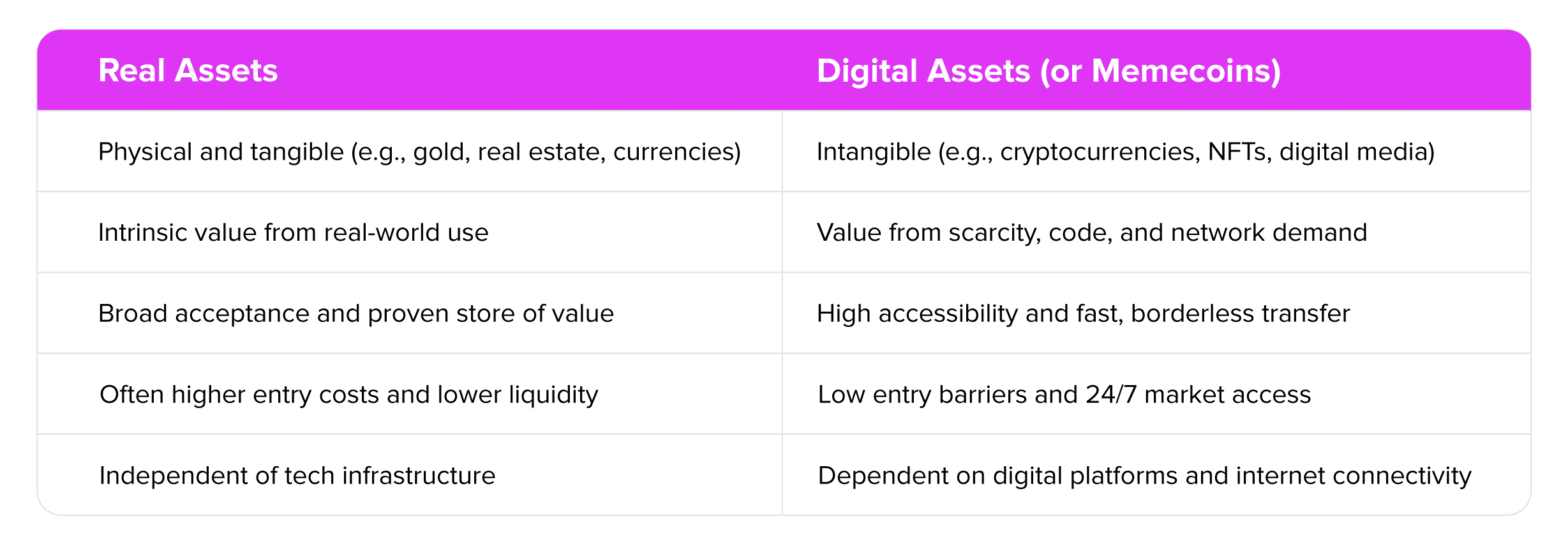

Real Assets vs Digital Assets

Think of it this way: real assets—like gold, real estate, and physical currencies—have intrinsic value and real-world utility, but often come with higher entry costs and lower liquidity.

Digital assets—such as cryptocurrencies, NFTs, and digital media—are intangible, easier to access, and can be transferred instantly around the world.

Tangible Assets vs Cryptocurrencies

Tangible assets (gold, cash) can be physically held and stored. Many cryptocurrencies, especially “unbacked” ones, have no physical form or intrinsic backing—their value comes entirely from demand and network trust.

Physical Gold vs Tokens

Gold delivers tangible utility, deep trust, and independence from tech infrastructure. Gold-backed tokens, however, offer speed, fractional ownership, and 24/7 liquidity—but rely on platforms, internet connectivity, and digital trust.

The Nature of Meme Coins

Memecoins, in contrast, are different—they’re born from culture, hype, and internet virality, often without inherent utility. Their value is driven by social buzz, symbolism, and speculation.

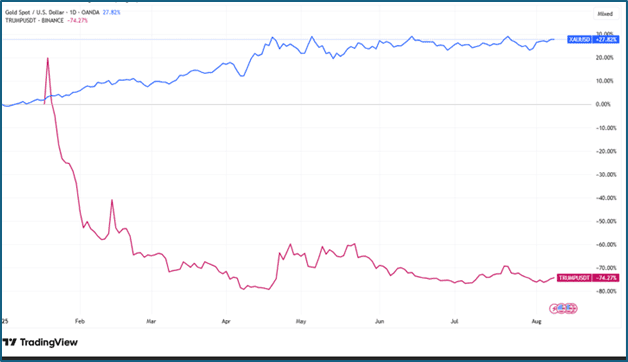

Take Trump Coin ($TRUMP), for example, which was launched in January 2025 by Trump-affiliated entities and peaked at $75.35 on April 19 before plunging to about $9.50 on Thursday, April 24, yet still holds a market valuation around of $2 billion.

(Source: Reuters) These assets are highly volatile, with much of the supply controlled by a small number of holders—often tied to the entities that created them—posing concentrated risk for new investors.

In summary

Case for Gold – Reliability and Longevity

Gold’s reputation as a safe store of value wasn’t built overnight—it’s been centuries in the making. It has acted as a safe haven in times of war, recession, and inflationary pressure. In 2025, gold has rallied strongly amid new tariffs on bullion, slowing job growth in the U.S., and broader geopolitical tensions.

Inflation Protection History

Over decades, gold has often outpaced inflation, particularly during economic turbulence. It has historically performed well when equity markets stumbled, though its short-term relationship with inflation is not always perfect.

Central banks worldwide hold gold reserves precisely because of the enduring market value of gold during geopolitical stress.

Recently, gold futures have reached record highs above $3,500 per ounce, with some analysts forecasting a climb toward $3,700 by year-end. Weak U.S. job market data has also increased the likelihood of interest rate cuts, further enhancing gold’s appeal in a low-yield environment.(Sources: Reuters, Zawya)

Case for Trump Coin – Meme, Movement, or Money?

Trump Coin, meanwhile, is more than just a cryptocurrency; it’s a blend of politics, culture, and speculation. For supporters, it represents political allegiance as much as an investment opportunity. For critics, it’s a speculative play with no inherent value.

What $TRUMP Represents

At its core, $TRUMP embodies political identity investing, a political memecoin, if you may. Holders often view it as both a cultural statement and a high-risk financial bet.

Since its launch, it has generated hundreds of millions in fees for Trump-linked entities. While early investors reaped substantial gains, many who bought in later have seen steep losses.

Aggressive marketing—including contests, token unlock events, and relentless promotion—has kept it in the public eye and contributed to its trademark volatility.

Market Speculation and Risk Profile

The token’s history has been defined by sharp swings, from an all-time high near $76 down to its current level around $9.00._ (Source: CoinMarketCap)_

Trading volumes remain strong, indicating ongoing speculative interest, but the risk remains elevated. Large upcoming token unlocks—releasing hundreds of millions of tokens—could put further downward pressure on prices if major holders decide to sell.

Read more: Understanding the Risks of Meme Coins: A Guide for New Investors

Public Sentiment and Trust Factors

Who Is Buying Gold? Who Is Buying Trump Coin?

Now… Trump Coin vs Gold… which asset do investors prefer?

Gold appeals to long-term investors, central banks, and individuals focused on wealth preservation. These buyers tend to take a cautious and strategic approach, valuing stability over fast returns. Trump Coin, on the other hand, attracts retail speculators, political supporters, and short-term traders chasing momentum. While it has a passionate following, it also faces skepticism from both traditional investors and parts of the crypto community.

In essence, even if we try to compare gold vs crypto, investors should conduct their own research before jumping in—reducing risks and boosting their trading potential.

Conclusion: Building a Portfolio That Balances Reality and Hype

A strong portfolio blends stability with opportunity. Gold provides the kind of enduring value that weathers inflation, market downturns, and policy shifts. Memecoins, while risky, can deliver rapid gains for those willing to speculate. The smart play? Gold and crypto diversification. Anchoring with tangible assets like gold while carefully sizing high-volatility bets such as $TRUMP to keep risk in check.

With amanainvest, you can trade across the spectrum—from gold to the latest memecoins—backed by transparent pricing, the largest crypto selection in MENA, and tools to help you invest wisely. Whether you’re seeking safe havens or high-risk plays, you can: • Pick a Pre-Built Plan based on risk level or asset class • Customise a Ready-Made Plan to suit your goals • Build Your Own with up to 20 assets (stocks, ETFs, crypto,* and more)

Enjoy zero management or exit fees, flexible recurring deposits, full automation, low or no minimum balance, and Sharia-compliant options—so you can invest your way, effortlessly.

Trump Coin vs Gold? Why not invest or trade both assets on amana?

Read Our Academy Trading Articles

Unlock expert trading strategies, market analyses, and step-by-step tutorials to sharpen your skills and grow your portfolio.

YTD Performance (%): Gold vs TRUMPUSD

Source: TradingView

| Related articles |