Gold.

From Spot to Gold ETFs:

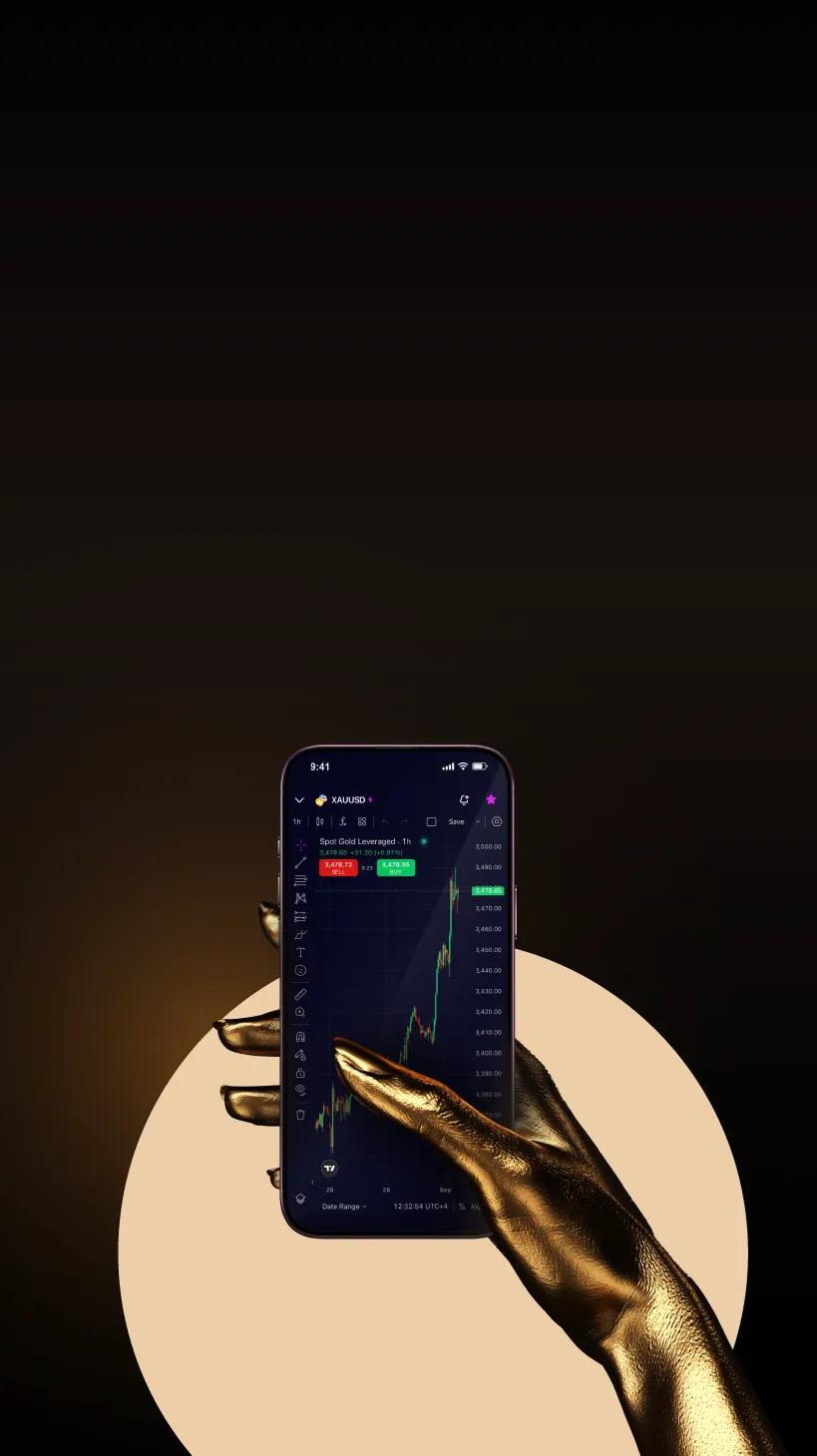

Trade Gold Your Way on amana

Why trade gold?

Gold trading lets you speculate on price moves without owning the metal.

People use it to hedge inflation and volatility, and to diversify their portfolios. It’s also one of the most popular assets among amana’s customers.

How to trade gold with amana?

Whether you want speed, leverage,

or long-term growth, amana has options.

Spot

Highly liquid, tradable 23h/5 days. Great for short-term moves.

Miners

Own gold-mining companies. Indirect exposure, some pay dividends.

Futures

Leveraged contracts on gold. No overnight fees, but mind margin, daily P&L, and contract expiries/rolls.

ETFs

Exchange-traded funds that track gold. Good for longer holds; some own physical bars, others use derivatives—check structure and fees.

Unleveraged: No

Unleveraged: No

Unleveraged: No

Unleveraged: No

Unleveraged: No

Asset

Spot Gold

Symbols

XAUUSD

Key Notes

Highly liquid,

tradeable 23h/5 days.

Great for short-term moves.

Leverage

Unleveraged

Overnight Fees

Yes

Asset

Gold Futures

Symbols

GC5Z

Key Notes

Leverage,

no overnight fees.

Watch expiry dates.

Leverage

Unleveraged

Overnight Fees

No

Asset

Gold ETFs

Symbols

GLD, SGOL, IAU, AAAU

Key Notes

Long-term friendly.

Some hold physical gold,

others use derivatives.

Leverage

Unleveraged

Overnight Fees

Leveraged: Yes

Unleveraged: No

Asset

Gold Miners

Symbols

NEM, AEM, WPM, GFI, AU, KGC, RGLD

Key Notes

Indirect exposure,

potential upside,

some pay dividends.

Leverage

Unleveraged

Overnight Fees

Leveraged: Yes

Unleveraged: No

Asset

Gold Miner ETFs

Symbols

GDX

Key Notes

Bundle of large mining companies;

correlated to gold prices (not perfectly).

Leverage

Unleveraged

Overnight Fees

Leveraged: Yes

Unleveraged: No

Asset

Junior Gold Miners

Symbols

HMY, BTG, CDE, EQX

Key Notes

Smaller, riskier, but bigger upside potential.

Leverage

Unleveraged

Overnight Fees

Leveraged: Yes

Unleveraged: No

Asset

Junior Gold Miner ETF

Symbols

GDXJ

Key Notes

Basket of small and mid-cap global miners. Diversified ‘junior exposure.

Leverage

Unleveraged

Overnight Fees

Leveraged: Yes

Unleveraged: No

Go for Gold.

Trade or invest in one

powerful amana app.

Got Questions?

Frequently Asked Questions

To trade gold in the UAE, you can use the amana trading app. Simply download the app, create an account, fund it, and start trading gold with ease.

There are several ways to gain exposure to gold — each suited to different goals and timeframes:

• Spot Gold: Highly liquid and tradable 23h/5 days. Ideal for short-term price moves.

• Miners: Shares of gold-mining companies — indirect exposure, some pay dividends.

• Futures: Leveraged contracts on gold with no overnight fees, but watch margin, daily P&L, and contract expiries or rolls.

• ETFs: Exchange-Traded Funds that track gold. Best for longer-term holds — some own physical bars, others use derivatives, so always check structure and fees.

And the best part? All of these are available for trade on amana with a tap.

You can trade gold commodities on various platforms in the UAE, and one of the convenient options is using the amana trading app. It offers access to commodities, allowing you to trade efficiently. From gold and silver to mining stocks and metal ETFs — trade it all at zero commission.

The best strategy for gold trading depends on your risk tolerance and market conditions. Some common strategies include trend following, day trading, and long-term investing. It's crucial to do thorough research and consider using the amana trading app's tools and resources to make informed decisions when trading gold.