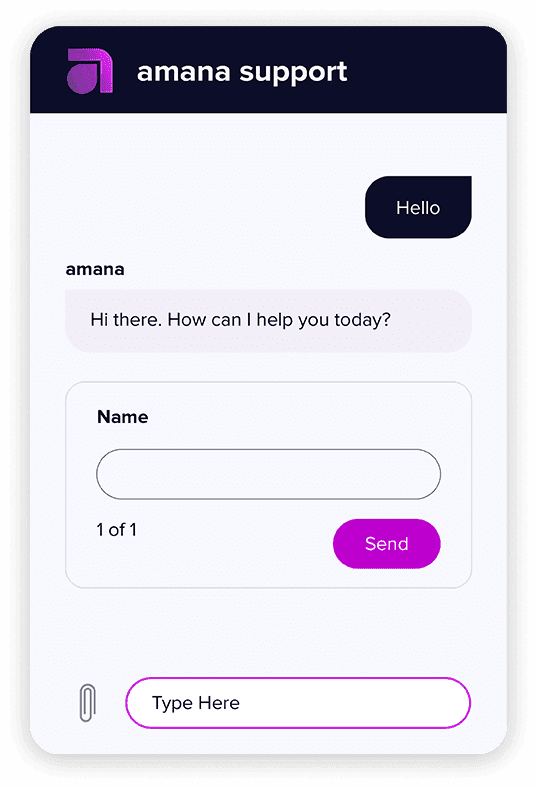

Contact us

Our Support Team is here to help

you 24 hours a day, 7 days a week,

in both English and Arabic. Simply drop us a message at

[email protected] or hit the chat

button below, and we’ll be right with you.

Need immediate help?

Get in touch with our Support Team via the chat icons above or through the Live Chat box at the bottom right corner of the page.

Why type when you can talk?

We’ll answer all your questions over the phone.

United Arab Emirates

T: +971 4 276 9525

Toll-free: 800-AMANA-APP

Cyprus

T: +357 25 25 79 80

Lebanon

T: +961 1 370 940

Malaysia

T: +60 875 045 53

Getting started

Proof of Identity (POI) is an official document such as your passport or, in the UAE, your Emirates ID. You must submit a valid passport or ID copy to verify your identity. If you’re submitting a government-issued identification card (ID), such as your Emirates ID, you must submit both sides.

Your copy must contain:

- Your full name.

- Your date of birth.

- A clear, passport-style photograph.

- A valid expiry date.

Note: Submitting the same document for both your POI and POR isn’t acceptable.

Proof of Residence (POR) is an address verification document with your full name and residential address, no more than six months old.

Examples of POA/PORs:

- Utility bills (electricity, water, gas, home internet or landline phone).

- Driver’s license, residence permit, national ID, or state ID.

- Bank statement, credit card statement, or bank reference letter.

- Council tax or municipality bill/government tax letter.

- Social insurance statement.

- An official letter from your employer verifying your address (stamped and signed).

Note: Submitting the same document for both your POI and POR isn’t acceptable.

By default, your account would be setup and regulated under our Malaysian entity, unless you request otherwise.

One major benefit of amana app is that we’ve got all your products in one place, so you don’t need an additional account. Nonetheless, additional account requests will be reviewed on a case-by-case basis.

During your registration, you'll be asked to provide your mobile number, and a code will be sent to you by text message. Type in the code for the confirmation and voila, your number is verified!

The minimum age required to open an account is 18 years old.

Even though online trading and investing are very popular and widely available, some countries are restricted or banned from accessing these services due to local or global regulations that we must abide by. And here are those countries:

| Iran | Crimea (part of Ukraine) |

| North Korea | Liberia |

| Canada | Burma |

| Syria | Eritrea |

| USA | Congo |

| Israel | Rwanda |

| Cuba | Somalia |

| Japan | Belarus |

The only currency applicable on amana mobile and web at this time is USD.

However, you can deposit your funds in AED through a wire transfer and we'll complete the conversion at a fixed rate of 3.68 for incoming and outgoing funds.

If you’re a US resident or liable to pay taxes in the US, we cannot open an account for you with amana. Sorry! This is a US regulation, and we have to abide.

We’re available 24/5 to support you through trading journey. Take advantage of our highly trained, multilingual team of trading and investing experts, who can help answer your questions.

Give us a call:

| United Arab Emirates T: +971 4 276 9525 | United Kingdom T: +44207 248 6494 | Lebanon T: +961 1370 940 |

| UAE toll-free number: 800AmanaApp |

Drop us an email:

Are you on socials? So are we!

Yes, amana is from the region and for the region. Founded in 2011, our headquarters are in the UAE. We also have offices in Lebanon, and new points of presence in Jordan and Qatar. Outside of MENA we have offices in Cyprus and the United Kingdom.

Amana Capital is a multi-licensed group regulated by various regional and international bodies like Financial Conduct Authority (FCA), Dubai Financial Service Authority (DFSA), and other international authorities. For the complete list of licenses, see below:

Amana Mena Promotional Services L.L.C

License Number 20200000255

Securities and Commodities Authority (SCA)

License Details: Know more

Amana Financial Services UK Limited

License Number 605070

Financial Conduct Authority (FCA)

License Details: Know more

Amana Financial Services (Dubai) Limited

License Number F003269

Dubai Financial Services Authority – DFSA

License Details: Know more

Amana Capital Ltd

License Number 155/11

Cyprus Securities and Exchange Commission (CySEC)

To view Amana Capital Ltd’s authorization, Know more

Amana Capital SAL

License Number 26

Capital Markets Authority (CMA)

License Details: Know more

AFS Global

License Number MB/18/0025

Labuan Financial Services Authority (LFSA)

License Details: Know more

ACG International Limited

License Number C118023192

Financial Services Commission - Mauritius (FSC)

License Details: Know more

You can visit our Support page and fill out the “Contact us” form, and we’ll get back to you as soon as possible.

amana app

This is the easiest part! Just type in what you love in our search bar at the top - for example, Apple, Bitcoin, Gold, or Etisalat.

Remember if it has a lightning bolt next to it, it’s the leveraged version.

To add an Asset:

- Search for the asset in the search bar.

- Swipe left on the desired asset.

- Press on the star icon.

To remove an Asset:

- Slide left on the asset you want to remove.

- Unselect the star icon.

To organize your watchlist:

- Go to your Watchlist.

- Long press on the asset you want to move and then drag it.

You don’t need to calculate the PL per position as the system does it automatically. But just in case, the formula is PL = (Entry price – Market/Exit Price) x Units.

To calculate the profit or loss on a closed position:

- BUY Position: PL = (Exit Price - Open Price) x Units x USD exchange rate

- SELL Position: PL = (Open Price - Exit Price) x Units x USD exchange rate

To calculate the profit or loss on an open position:

- BUY Position: (Last Price – Avg. Price) x Units x USD exchange rate = PL

- SELL Position: (Avg. Price - Last Price) x Units x USD exchange rate = PL

Instruments traded in US Dollars do not require a conversion so the USD exchange rate in the formula is 1.

In the Portfolio section, tap the down arrow next to your Account Value to display your account metrics. The value under “Today” displays the change in value of your account since the end of the previous business day at 5pm EST. This value will include your PL for the day plus any deposits or withdrawals. Any realized PL generated during the current day can viewed under “Portfolio” > “Orders” > “Activity.” Your realized PL for previous days can be found on your statements.

You can see them under the “Positions” tab in the “Portfolio” section.

To view your closed positions for the current day, go to the “Portfolio” section, then the “Orders” tab, and you’ll find them under “Activity.”

For previous days, go to the “Profile” section, then hit “Statements.” Then select the date you want, and you’ll see all the positions closed that day. You can also download your statement by pressing the download icon.

To see your open order, head to the “Orders” tab under “Portfolio.” You will see them under “Working Orders”.

To see today’s order history, head to the “Orders” tab under “Portfolio.” You’ll find them under “Activity.” If you want to see previous days, head to “Statements” under “Profile,” choose the desired date, and you’ll find them under “Orders.”

Setting a price alert for an asset is super easy. To set an alert:

- Go to Watchlist

- Swipe left on the asset

- Press on the bell icon

- Type in the price for your alert

OR

- Go to Watchlist.

- Press on the asset’s name.

- Press on asset info.

- Press on the bell icon in the top right corner.

- Type in the price for your alert.

- Choose the method of notification.

- Create the alert.

To modify your price alert:

• Head to the “Alerts” tab under the “Portfolio” section.

• Slide the “Price” alert order to the left.

• Press on the pen icon to modify.

• Adjust your price alert.

- update your alert.

From “Portfolio” > “Positions”, slide the position bar left and press either the modify position or close position button. All your position details will display, including any Fees.

Also, once your position is closed, you’ll see them in your statement under “Fees.”

To see your statements, head to the “Profile” section.

Once the position is closed, you'll see them under “Fees” in your statement.

To see your statements, head to “Profile.”

Yes, to close a position partially, simply place an order in the opposite direction.

For example, let’s say you have a Buy position of $500 EURUSD. You could sell $200 to close it partially. Your net position would become a Buy of $300.

Of course, you can!

- Go to the “Portfolio” menu.

- Then go to the “Positions” tab.

- Swipe left on the desired position to close.

- Press on the “x” button.

- And confirm your closing order.

To view your closed positions for the current day, go to the “Portfolio” section, then the “Orders” tab, and you'll find them under “Activity.”

For previous days, go to the “Profile” section, then choose “Statements” and select your desired date. To view only US exchange traded stocks and ETFs products, choose “US Securities Statements. You can also download your statement by pressing the download icon. It’s that simple!

The Portfolio section values are explained below.

Account value: Available + Total Invested

Available: Remaining funds available to trade

Total Invested: The total initial equity required to open your positions

Today: The change between yesterday's & today's Account Value, including deposits & withdrawals

Portfolio PL: The sum of your open positions' PL

Health Level: Account value / Total Invested

Today %: Today / Yesterday's end of day Account value

Amount: The value you want to invest in the trade

Units: The size of your trade specific to the instrument

Investing: The equity required for the position

Last: The last traded or exit price of the instrument

PL: the amount of profit or loss on a position, including fees

Invested: The initial amount of equity required for the position

Avg. Price: The average price of your positions

Current value: Invested + PL

Fees: Includes Overnight fees And Clearing fees (applicable for MENA stocks)

Profit: (Last price - average price) x units x USD conversion

Exposure: The total value of the position in account currency, representing the total amount at risk

Proximity: The difference between the order price and market price in percent

SL: Stop loss

TP: Take profit

When you buy US Shares with Amana, the securities are held in your name. When you buy Regional Shares, Amana holds the securities on your behalf.

No, you don't own physical cryptocurrencies when trading. Instead, you own cryptocurrency derivatives.

Crypto derivatives eliminate the need for navigating wallets and other tricky market infrastructure. Crypto derivatives give you exposure to the crypto’s price movement without the risks associated with physical tokens

Amana does not offer any tax advisory. For clients residing abroad and/or having other foreign tax obligations, please check in with your tax advisor.

When you complete the registration with amana, you have a live account ready for funding and trading. amana does not offer a practice account.

The time used on Charts and Positions will match the time zone set on your mobile phone. As for Statements, it’s amana’s Server time which is GMT +2.

Yes it does. To change the language on the app:

- Go to “Profile.”

- Press on “Settings.”

- Then press on “Arabic” to auto-switch

It’s that easy!

Usually, when a position closes automatically without you closing it manually, it’s one of these three scenarios:

- Your position hit an SL (stop loss) or TP (take profit) order that was placed from your side.

- Your position got stopped out (SO) due to insufficient funds.

- Your account was liquidated due to insufficient funds.

Amana doesn’t offer this service at the moment, but we’re looking to add it soon. Stay tuned!

Charting in the app displays the Ask price for derivative products and the Last price for exchange traded stocks.

For derivative products, “Last” in the Positions detail displays the price at which a position can be closed.

For Buy positions, that means “Last” will show the Bid price.

For Sell positions “Last” will show the Ask price.

For exchange traded stocks, “Last” will be the most recent price at which the asset was traded on an exchange.

That price may be different from the current Bid or Ask price.

Your (PL) found in your Positions screen reflects if you are in a (Buy) or (Sell) position, and has smart logic to take the price at which you would trade to exit the position. This gives you the most accurate understanding of your true PL if you were to exit.

For instance, if you are in a Buy position then to close that position you would need to Sell the asset, which would execute at the Bid price. Likewise, if you are in a Sell position and you wanted to close that position you would need to Buy the asset which takes the Ask price. Your PL could be negative if the Bid price on your Buy position is lower than your Avg Price or due to overnight fees from holding the position over time.

A difference between the price you see on the chart (Ask or Last) and what is shown in your Position screen (Bid, or Ask) can occur due to the difference between the Bid and Ask price of the asset and the direction you of your position. Our charts show the Buy price for derivatives and the last traded price for exchange traded stocks. To verify the current Bid or Ask of an asset you can simply open an order ticket for that asset, or change your Watchlist View to “Bid & Ask” at Profile > Settings.

Trading and investing

A position is the amount of an asset (e.g., a currency or stock) owned by an individual or organization that has exposure to market movements and can generate a profit or a loss.

An order is a set of instructions you place to buy or sell an asset.

Your account leverage is, by default, set to 1:100 for currencies, metals, and commodities. As for shares and cryptocurrencies, the leverage varies from 1:2 up to 1:20, depending on the asset. You can find the offered leverage on any asset in the “Asset Info” tab or while placing an order (i.e., 5x, 20x, 100x, etc.). You can recognize it by the lightning bolt icon.

Only products with a lightning bolt icon next to them will have any type of leverage.

At this time, all amana accounts are in US Dollars.

The difference between trading with and without leverage is whether the amount required to open a position is the same as the asset’s exposure or not. When you trade with leverage, the USD value of the asset you’re trading is multiplied by the leverage ratio chosen.

For example, a 1:5 leverage means you use $100 to trade $500 worth of an asset.

When you trade without leverage, you’re trading with “cash value.” That means the amount of capital required to open a position is equal to the exposure to the asset.

Overnight fees are daily charges for holding a leveraged position where the total value of the position is greater than the amount required to place the trade.

For example, if you trade $1,000 worth of Apple stock with a leverage of 1:5, then you have a total position value of $5,000.

Leverage is a trading service that lets you trade more of an asset than what your deposited amount is worth.

For example, $1,000 on a Disney stock with a leverage of 1:10 allows you to invest a value of $10,000.

Leverage is a great tool to increase your potential profit, but also your potential losses. It can be a double-edged sword, and we advise all our users to keep their risk in check at all times!

Keep in mind that when you trade on leverage, the difference between your deposited amount ($1,000) and your leveraged amount ($20,000) is a loan provided by your broker. That’s why, if you keep your leveraged position open for over 24 hours, you pay what is known as “overnight fees”.

A negative balance occurs when losses exceed the amount of funds in the account. This situation can happen when trading leveraged products where the amount of capital to enter the trade is less than the total value of the trade. In volatile market conditions, where prices move quickly or when markets gap, losses can exceed the amount used to open the trade and lead to a complete loss of your deposit, or even a loss greater than your deposit.

No, cryptocurrencies aren’t regulated. They’re decentralized networks based on blockchain technology, which is a public distributed ledger across a large network. Because they’re not issued by any central bank, they’re theoretically immune to government interference and/or manipulation.

Under normal market conditions, your SL orders will typically be executed at the price you set.

But under abnormal conditions, the market is vulnerable to high levels of volatility, during which market gaps might happen. In a fast-moving market or a gap situation, your stop-loss order may be executed at a price different than requested.

Under normal market conditions, your SL orders will typically be executed at the price you set.

But under abnormal conditions, the market is vulnerable to high levels of volatility, during which market gaps might happen. And they could put you in a tight spot, where your stop-loss order is executed at a worse price. I.e., NFP (non-Farm Payroll) or Central Bank rate decision events.

To avoid the latter scenario, it’s best to stay out of the market before, during and after breaking news events. Usually, the effects unfold within 15 to 20 mins, then the market is (typically) back to normal conditions.

Under normal market conditions, your limit orders will be executed at the price you set or better.

Yes, you can, as long as there’s a market open on the weekend in question. For the time being, this only applies to crypto. To know more about the markets’ opening and trading hours.

By definition, a trade is the act of exchanging one thing for another or buying and selling goods and services. In this case, it would be exchanging your deposited USD amount into asset investments of your choice, like buying an Apple share, 10 ounces of gold, a couple of thousand barrels of oil, or a currency pair, such as EUR/USD. Whether your trade is executed at market price or at a pre-defined price, it’ll still be considered a trade.

A market gap is a sharp upward or downward change in a stock’s price (or another financial asset), where little or no trading activity has taken place. When this happens, you will typically find the term “market gap” or “gap” used on the asset’s chart, as shown below.

Whether upwards or downwards, gaps often take place because of:

- Company earnings reports that show better-than-expected profits or dividend distribution.

- Company announcements, such as a new hire or the termination of a Senior level employee or a Board of Directors member.

- Product announcements. For example, a certain defect or default that forces a company to withdraw part of their stock from the markets.

The terms “gap up” or “gap down” refer to the direction of the market gap. If the asset price moves upwards, it’s a gap up. And if the price of the asset moves downwards, then it’s a gap down.

Usually, gaps are classified into four types depending on the price pattern. Some investors study these types of gaps to help inform their trading strategy.

Here are the four types of market gaps:

- Common gap: The common gap simply shows a gap in price, irrespective of a certain price pattern.

- Breakaway gap: Positioned at the end of a ranging chart price pattern, this gap signals the beginning of a new pattern forming (upwards or downwards).

- Continuation gap: This gap takes place in the middle of an existing price pattern (upwards or downwards) and signals an additional rush of new buyers or sellers that share a common belief about the stock’s future direction.

- Exhaustion gap: This gap is considered the opposite of a continuation gap. It takes place at the end of a price pattern, signaling a last attempt to hit new highs or lows before a price pattern reversal.

Yes! Dividends are deposited directly into our investors’ trading accounts based on their investments.

When the Board of Directors vote to distribute dividends, they’ll announce the dividend, the size of the dividend, the record date, and the payment date. This announcement is called the declaration date.

The record date is the day by which you should be on the company’s books as a shareholder, so you receive the declared dividend. And the payment date is when the company pays the dividend to shareholders who own the stock before the ex-dividend date, which is the trading date when a new shareholder isn’t entitled to a dividend on the stock.

Your dividend payments will be respective to the underlying share/stock investment in your portfolio. Should the stock you’re holding distribute a dividend, it’ll be credited into your account within the next 5 to 7 working days after the payment date.

Amana doesn’t allow after-hours trading just yet.

Market trading hours are as follows:

- The currencies, metals, commodities and indices markets are open 24 hours a day, 5 days a week.

- The crypto market is open 24 hours a day, 7 days a week.

- Stock exchanges have different market hours, see below:

| Days | GMT +2 | |

| US | M - F | 17:30 - 00:00 |

| UK | M - F | 11:00 - 19:30 |

| France | M - F | 11:00 - 19:30 |

| Spain | M - F | 11:00 - 19:30 |

| Italy | M - F | 11:00 - 19:30 |

| Netherlands | M - F | 11:00 - 19:30 |

| Belgium | M - F | 11:00 - 19:30 |

| Germany | M - F | 11:00 - 19:30 |

| UAE | M - F | 10:00 - 14:45 |

| Qatar | Sun - Thu | 10:30 - 14:00 |

| Saudi Arabia | Sun - Thu | 11:00 - 16:00 |

| Kuwait | Sun - Thu | 10:00 - 13:30 |

| Egypt | Sun - Thu | 12:00 - 16:15 |

Most of our products can be traded with zero commissions. For the rest, what you pay is what we pay. That way, as our community grows, so does our opportunity to bring costs down for everyone.

A breakdown of our fee structure can be found here.

The policy change is effective from January 2, 2024.

Brokers typically charge commissions based on the order value, and some exchanges added additional fees. For example, the Dubai exchange (DFM) charges around 10 AED per trade, and the Kuwait exchange charges 7.50 KWD per fill. amana’s new policy covers all execution costs so there is no charge to trade MENA shares at amana.

All new and existing amana clients are automatically included in the new policy.

All new and existing users will pay no commissions or fees on trades made on or after the effective date, up to the first $100,000 worth of MENA shares traded.

Yes, the offer is limited to the first $100,000 worth of MENA shares traded, and after this threshold, the current "Our Cost is Your Cost" policy applies. Additionally, there are restrictions on the number of trades for DFM and Boursa Kuwait listed companies. The offer is limited to 50 trades on DFM listed companies and 5 trades on Boursa Kuwait listed companies.

Yes, overnight fees still apply to leveraged CFD MENA shares.

No, trades executed before the effective date are excluded, and reimbursement will not be provided for those trades.

Clients do not need to request enrollment; the policy is automatically applied to both new and existing customers.

No, this is not a temporary promotion. The policy will remain in effect until one of the specified limits is reached ($100k traded, 50 DFM trades, or 5 Kuwait trades).

The policy covers markets such as Dubai (DFM), Abu Dhabi (ADSM), Egypt (CASE), Kuwait (KSE), and Saudi Arabia (TDWL). The included products are ETPs (exchange-traded shares) and CFDs (share derivatives).

amanainvest

Deposit and withdrawal

A refund is the process of withdrawing and returning funds to the same source previously used to deposit your funds. All refunds have to be sent to the original source of payment, as per amana’s policy and International Money-Laundering (AML) regulations.

A CVV, also known as “Card Verification Value,” is the three-digit code printed on the back of your bank card. Turn your card over to see your CVV.

A CVV serves to establish the card owner’s identity and minimize the risk of fraud.

3-D Secure, also known as “Payer Authentication”, is a security protocol that adds an extra layer of protection to your online debit/credit card transactions. Different card networks have developed their 3-D Secure systems, so your authentication will be branded with messages like “Verified by Visa” or “MasterCard Secure Code”. Whenever you receive an authentication request, simply enter the one-time PIN you receive via SMS into the required field.

You can find your SWIFT and IBAN codes on your bank account statement or within your online banking app.

- A SWIFT code, also known as a “BIC,” is an eight-digit number that helps any bank across international borders to identify your bank.

- An IBAN code, also known as the “International Bank Account Number,” helps banks to identify your specific bank account when processing a payment.

Note: If you’d like to request a withdrawal to a bank that doesn’t have an IBAN code, enter your account number into the IBAN field on the “Withdrawal” page, followed by your bank’s branch code in the comments field.

Yes, we do. Our local deposits are available for residents of the UAE, UK, and Cyprus. To know more, get in touch with us at [email protected].

Our Payments Team is available 24/5, from Monday to Friday. You’re welcome to send your deposit/withdrawal request during the weekend; however, we’ll only be able to process it during working hours.

Note: If you deposit any time on Saturday or Sunday afternoon, the transaction should be reflected in your account before the market opens on Sunday at midnight.

amana currently banks with Mashreq Bank and First Abu Dhabi Bank.

Stocks and ETFs

Amana counts your day trades in US securities in the Profile section of the app to prevent violations of the Pattern Day Trading rule. You will see a counter that displays the number of day trades you have completed. Once a customer has 3 Day Trades, no buy orders in US shares or ETFs will be accepted until one of the Day Trades rolls out of the 5-day period. There are no restrictions on reducing or closing any open positions in US shares or ETFs.

US Regulators implemented a Pattern Day Trading rule in 2001 as a safety feature to help reduce the risk associated with short term trading. The rule attempts to prevent inexperienced traders from trading too much and also attempts to prevent them from incurring large losses.

Pattern Day Trading only applies to trades in US securities including shares and ETFs. Trades in forex, derivatives and crypto are not subject to Pattern Day Trading requirements.

A Day Trade is when a buy order and a sell order of the same symbol are executed in an account in one trading day.

US regulation defines a Pattern Day Trader as an account that does 4 or more “Day Trades” within any 5-day rolling period. A Day Trade is when a buy order and a sell order of the same symbol are executed in an account in one trading day. Customers that are tagged as Pattern Day Traders must maintain $25,000 worth of US shares in their securities account.

If you hold over $25,000 of US shares or ETFs in your securities account, you are able to engage in Pattern Day Trading. Customers that have less than $25,000 of US shares or ETFs in their securities account are allowed 3 Day Trades over a 5-day rolling period.

Amana counts your day trades in US securities in the Profile section of the app to prevent violations of the Pattern Day Trading rule. You will see a counter that displays the number of day trades you have completed. Once a customer has 3 Day Trades, no buy orders in US shares or ETFs will be accepted until one of the Day Trades rolls out of the 5-day period. There are no restrictions on reducing or closing any open positions in US shares or ETFs.

TLDR: Yes, our clearing broker is a member of the Securities Investor Protection Corporation (SIPC), which means your cash and securities are protected up to $500,000 (including up to $250,000 cash) in the case of firm failure. Please note, SIPC does not protect against gains and losses from market fluctuation.

To know more about SIPC, click here.

Troubleshooting

For a faster and smoother approval process, your documents must be uploaded as a live screenshot instead of uploading a picture or document, especially the POI (Passport, Government ID). As for the POR, there’s no need for a live screenshot if the document is of good quality and easy to read.

If you were unable to upload your documents on the app, send them by email to [email protected] to complete your registration.

You won’t be able to login with your previously registered email address. Sign up for a new account on the mobile app using a different email address. To know more, contact our Support Team on [email protected] or on Live Chat.

If you’re an existing amana client or a previously registered user, you’ll need to use a different email address to sign up for an account. Get in touch with our Support Team on Live Chat or sign up using a new email address.

Don’t worry; you didn’t spend your time in vain. Your registration was saved at every step. Simply log into the Web/Mobile app again and press on “Incomplete Steps” to resume and submit once done.

If you’re logged in:

Go to Profile, press on “Log Out” to go back to the Login page. Then press “Forgot Password,” enter your email address, and a reset password link will be sent to your email. Follow the steps there and create your new password.

If you’re logged out:

On the Login page, press on Forgot Password, add your email address, and a reset password link will be sent to your email. Follow the steps there and create your new password.